From the Foggy Goggle to the Darknet: 2024 Links on Tor and crime Report

Hey there! I’m sitting in the cozy and slightly mysterious ambiance of the Foggy Goggle, a local pub known for its healthy pub fare and creative cocktails. As I sip on a locally brewed beer, I’ve immersed myself in the latest “2024 Crypto Crime Report.” This document is a treasure trove of information about the dark underbelly of the cryptocurrency world, covering everything from darknet markets to sophisticated scams and fraud. Let me take you on a journey through some of the most intriguing findings from this report.

2023 was a year of recovery for the cryptocurrency industry, bouncing back from the chaos of 2022. The market saw a significant rebound, with increasing activity suggesting that the “crypto winter” might be ending. However, this resurgence also came with its challenges, particularly in the realm of crypto crime. Despite a general decline in scamming and stolen funds, ransomware and darknet market activities saw a worrying rise.

Top Darknet Markets: 2024’s Major Players

Darknet markets continue to be a central hub for various illicit activities, from drug trafficking to the sale of stolen data and counterfeit goods. Despite efforts by law enforcement to shut down these markets, they remain resilient and adaptable. Here, we delve into the top darknet markets of 2024, highlighting their key characteristics and the scope of their operations.

Darkweb Markets links on Tor :

| Darknet Market | Established | Commission | Total Listings | Business Volume | Link |

| Ares | 2019 | 0.15% – 0.25% | 100+ | $10 million+ | Onion Link |

| Nexus | 2023 | 0.10% – 0.20% | 110+ | $20 million+ | Onion Link |

| Vortex Shop | 2024 | 0.05% – 0.15% | 300+ | $5 million+ | Onion Link |

| Flugs | 2016 | 0.00% – 0.10% | 400+ | $40 million+ | Onion Link |

| We are north | 2023 | 0.05% – 0.10% | 150+ | $12 million+ | Onion Link |

| Abacus Market | 2022 | 0.05% – 0.15% | 100+ | $20 million+ | Onion Link |

| Sipulitie Market | 2023 | 0.10% – 0.20% | 200+ | $15 million+ | Onion Link |

1. AlphaBay

- Overview: AlphaBay, which was resurrected in 2021, remains one of the most significant darknet markets. Known for its wide array of illicit goods, including drugs, weapons, and stolen data, AlphaBay operates with a high level of security and user anonymity.

- Key Features: Multisignature escrow, enforced vendor PGP encryption, and support for multiple cryptocurrencies including Bitcoin and Monero.

2. Torrez Market

- Overview: Torrez has become a prominent player in the darknet market scene, offering a user-friendly interface and a diverse range of illegal products. It has gained popularity for its reliability and the high level of trust within its user base.

- Key Features: Decentralized hosting, automated dispute resolution, and regular security updates.

3. White House Market

- Overview: Known for its strict vendor policies and emphasis on user security, White House Market is highly regarded for its selection of high-quality products and services. It mandates the use of Monero for all transactions, enhancing user privacy.

- Key Features: Mandatory PGP encryption, multi-factor authentication, and detailed vendor vetting processes.

4. ToRReZ Market

- Overview: ToRReZ is another top contender, recognized for its extensive product listings and robust security measures. The market supports various cryptocurrencies and employs sophisticated anti-DDoS protection to ensure uptime.

- Key Features: Advanced search filters, detailed product descriptions, and a responsive customer support system.

5. Versus Market

- Overview: Versus Market is gaining traction for its unique features and strong community engagement. It offers a variety of digital and physical goods, along with a reputation system that helps users identify trustworthy vendors.

- Key Features: User-friendly interface, vendor transparency, and a community forum for discussions and reviews.

Ransomware: A Growing Threat

Ransomware has become a major concern in the cryptocurrency landscape. The report highlights that 2023 marked a record high for ransomware payments, exceeding $1 billion. This alarming increase followed a year of decline in 2022. Ransomware actors targeted high-profile institutions and critical infrastructure, including hospitals, schools, and government agencies.

Key Statistics:

- Total Value Received by Ransomware Attackers (2019-2023): Steady increase, with a peak in 2023.

- Major Attacks: The exploitation of the MOVEit file transfer software, impacting entities like the BBC and British Airways.

The landscape of ransomware is expanding, with an increasing number of threat actors and more sophisticated attacks. For instance, the Cl0p ransomware group’s exploitation of zero-day vulnerabilities allowed them to extort numerous victims, leading to significant financial gains.

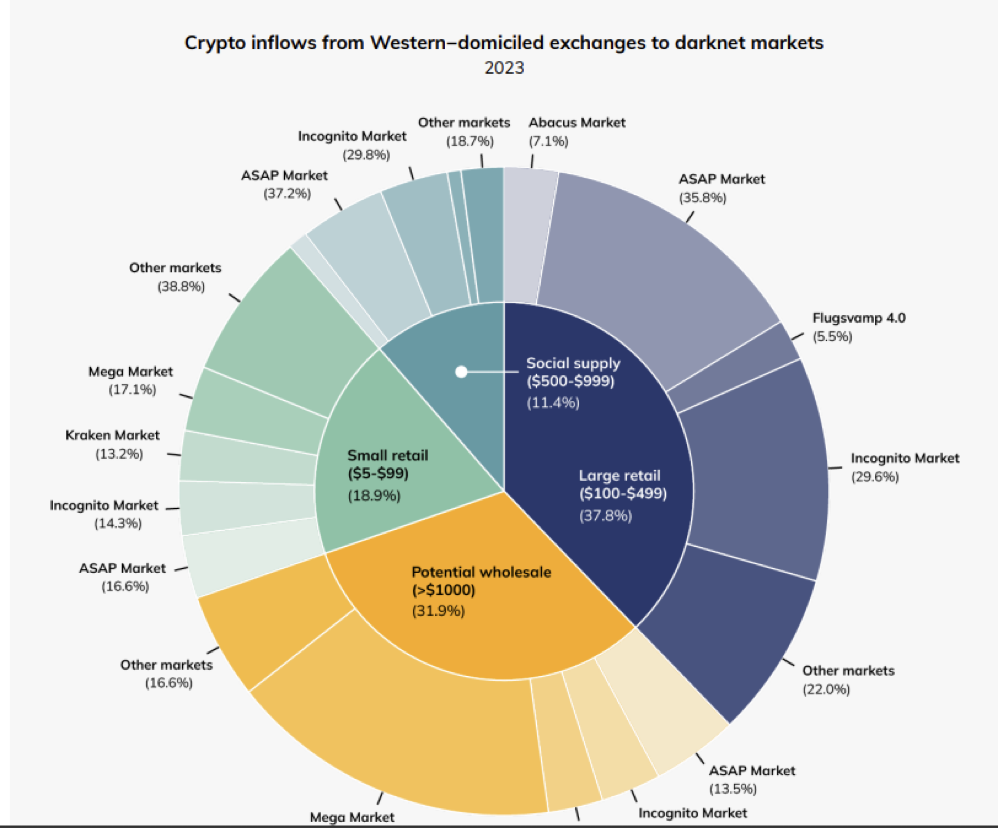

Darknet Markets: Resilience and Growth

Darknet markets have shown a remarkable ability to rebound after major disruptions. The shutdown of Hydra, a dominant market, in 2022 caused a temporary decline in darknet market revenue. However, 2023 saw a resurgence, with total revenue climbing back towards its 2021 highs.

Highlights:

- Resurgence Post-Hydra: New markets emerged, although none have yet dominated like Hydra.

- Revenue Growth: Darknet market revenues rose significantly, indicating a robust underground economy.

The report emphasizes the role of darknet markets in facilitating various illicit activities, from drug trafficking to the sale of stolen data. Despite law enforcement efforts, these markets continue to thrive, adapting quickly to shutdowns and disruptions.

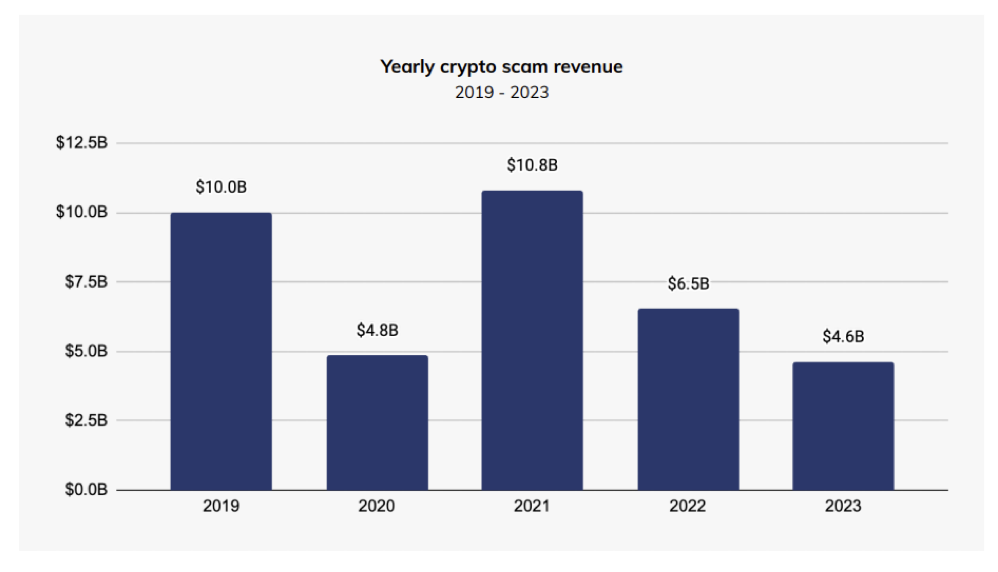

Scams and Fraud: Shifting Tactics

Interestingly, while overall scamming revenue decreased in 2023, the tactics used by scammers have evolved. The report notes a significant decline in broad-based investment scams and a rise in more targeted approaches, such as romance scams.

Key Points:

- Revenue Decline: Scamming revenue dropped by 29.2%.

- Targeted Scams: Increase in romance scams, where scammers build relationships with victims before pitching fraudulent investments.

These changes reflect broader market dynamics, where scammers are adapting their methods to be more personal and harder to detect. The impact on victims remains severe, often resulting in substantial financial and emotional distress.

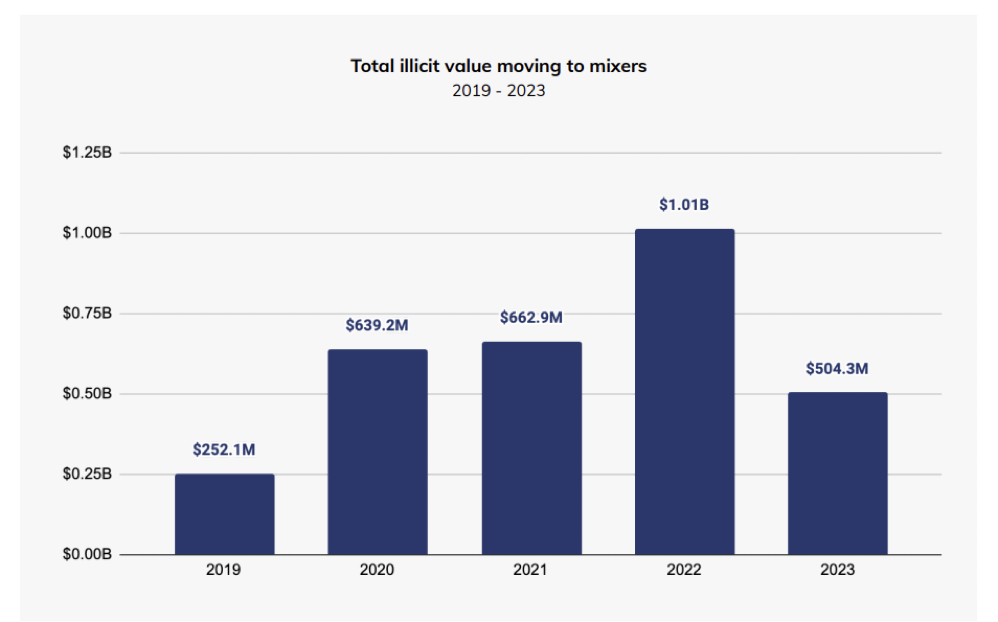

Money Laundering: Evolving Techniques

Money laundering remains a significant issue in the crypto space. The report details how sophisticated criminals are using a variety of methods to obscure the origins of their funds. In 2023, $22.2 billion worth of cryptocurrency was sent to illicit addresses, marking a 29.5% decrease from 2022.

Notable Trends:

- DeFi Protocols: Increasing use of decentralized finance (DeFi) protocols for laundering funds due to their transparency and lack of centralized control.

- Mixers and Bridges: Utilization of mixers and cross-chain bridges to further obfuscate transactions.

These methods highlight the ongoing cat-and-mouse game between criminals and law enforcement. As new technologies and platforms emerge, so do new opportunities for laundering illicit funds.

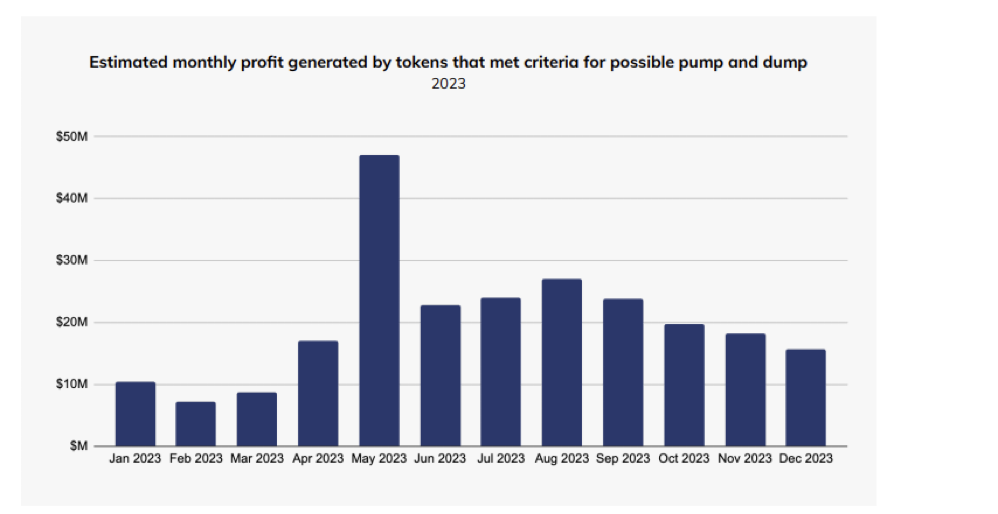

Market Manipulation: Pump and Dump Schemes

The report also sheds light on the prevalence of market manipulation, particularly pump and dump schemes. In 2023, approximately 90,408 tokens launched on Ethereum met the criteria for potential manipulation, representing 24.4% of all tokens launched on the network.

Insights:

- Criteria for Pump and Dump: Tokens that saw significant buying activity followed by a single address removing the majority of liquidity.

- Estimated Profits: Actors involved in these schemes collectively made around $241.6 million.

These schemes continue to plague the cryptocurrency market, exploiting the lack of regulation and the rapid pace of new token launches. Identifying and mitigating such activities remains a challenge for market operators and regulators.

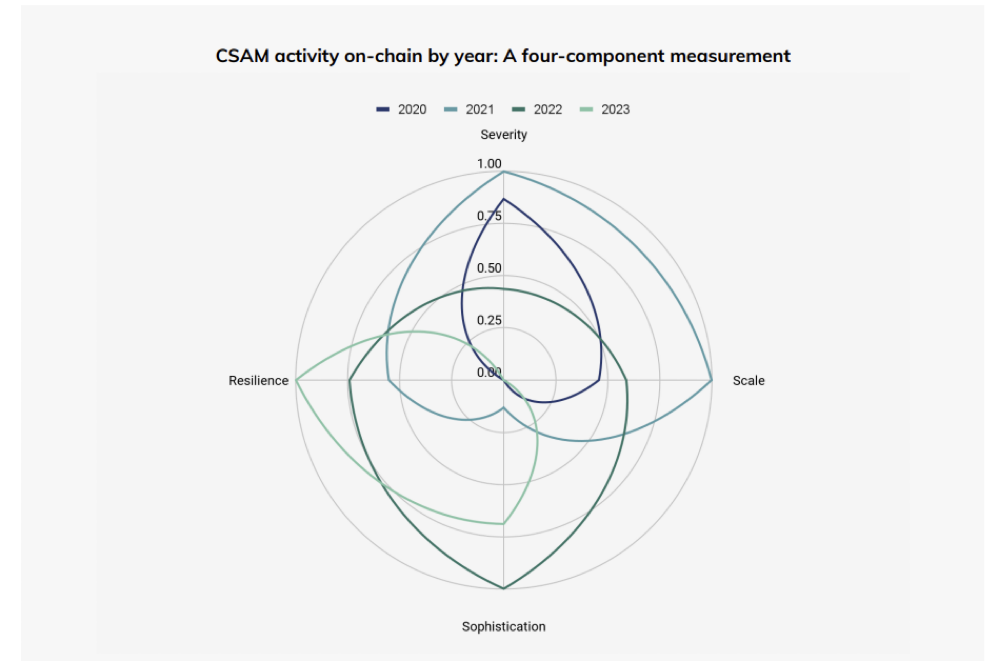

CSAM and Privacy Coins

Child sexual abuse material (CSAM) vendors have increasingly turned to privacy coins like Monero to evade detection. The report identifies over 400 on-chain CSAM vendor wallets active between 2020 and 2023, highlighting a disturbing trend in the use of cryptocurrency for such heinous activities.

Findings:

- Use of Mixers: Significant inflows and outflows to/from mixers to obscure transactions.

- Monero: Preferred by vendors for its strong privacy features.

The use of privacy coins and sophisticated obfuscation techniques makes tracking and combating CSAM-related transactions particularly challenging for law enforcement.

Cheers , do you liked my report ?

The “2024 Crypto Crime Report” provides a comprehensive overview of the evolving landscape of cryptocurrency crime. From the rise of ransomware and darknet markets to the changing tactics of scammers and the persistent challenge of money laundering, the report underscores the need for continued vigilance and innovation in combating crypto crime.

As I finish my drink at the Foggy Goggle, it’s clear that while the cryptocurrency industry holds immense potential, it also faces significant risks. Addressing these challenges will require collaboration between industry stakeholders, law enforcement, and regulatory bodies to ensure a safer and more secure crypto ecosystem.

Cheers to a future where we can harness the power of cryptocurrency while mitigating its risks!